Chapter 1: Understanding a Budget

A budget, in financial terms, is a structured plan that outlines expected incomes and expenditures over a certain period. It serves both as a forecast and a yardstick by which financial discipline can be measured. For governments, such as in the case of Pakistan’s budget 2024, it help prioritize spending, manage economic policies, and allocate funds for public services, impacting various sectors including Real Estate.

Chapter 2: Budget’s Impact on Real Estate

Pakistan’s budget 2024 directly impacts the real estate sector through alterations in tax policies, infrastructure spending, and investment incentives. Changes in taxation can affect the costs of buying, selling, and developing properties, thereby influencing market prices and investment returns. Budgets often allocate funds for urban development projects that can enhance property values in those areas, crucial for developers strategizing around government incentives.

Chapter 3: Specifics of the 2024 Budget for Real Estate Sector

3.1: Tax Exemption for Overseas Pakistanis

The 2024 budget introduces a tax exemption for overseas Pakistanis purchasing property through remittances. This significant measure is designed to attract more investment from the diaspora, potentially revitalizing the real estate market by increasing demand in various segments.

3.2: Reduction of Tax Burdens on Existing Businesses

In an effort to foster growth and sustain investment within the sector, the government has announced a 10% tax reduction for existing real estate businesses, spread over the next three years. This relief is expected to enhance profitability and encourage further development activities within the sector.

3.3: Stimulating Market Liquidity

By refraining from introducing new taxes and reducing existing burdens, the budget aims to inject liquidity into the real estate market. These fiscal policies are expected to alleviate some of the financial pressures faced in previous years, encouraging both local and international investment.

Chapter 4: Impact of the 2024 Budget on Property Buying and Selling

4.1: Enhancing Property Transaction Appeal

The absence of new taxes and the reduction of existing ones in the 2024 budget are set to make buying and selling properties more financially attractive. These changes are likely to lead to an increase in property transaction volumes, which will benefit the entire real estate ecosystem including brokers, agents, and other professionals.

4.2: Boosting Demand through Overseas Investment

The tax exemptions for overseas Pakistanis are expected to significantly boost demand, particularly in the luxury and premium segments of the market. This targeted approach aims to draw more investments into Pakistan’s real estate sector from abroad, enhancing its global competitiveness and appeal.

4.3 Market Dynamics and Investment Opportunities

With the implementation of these budget measures, the real estate market is anticipated to experience more dynamic and robust activity. Investors and developers will find more opportunities as the market conditions improve, making it an ideal time for strategic investments and project initiations.

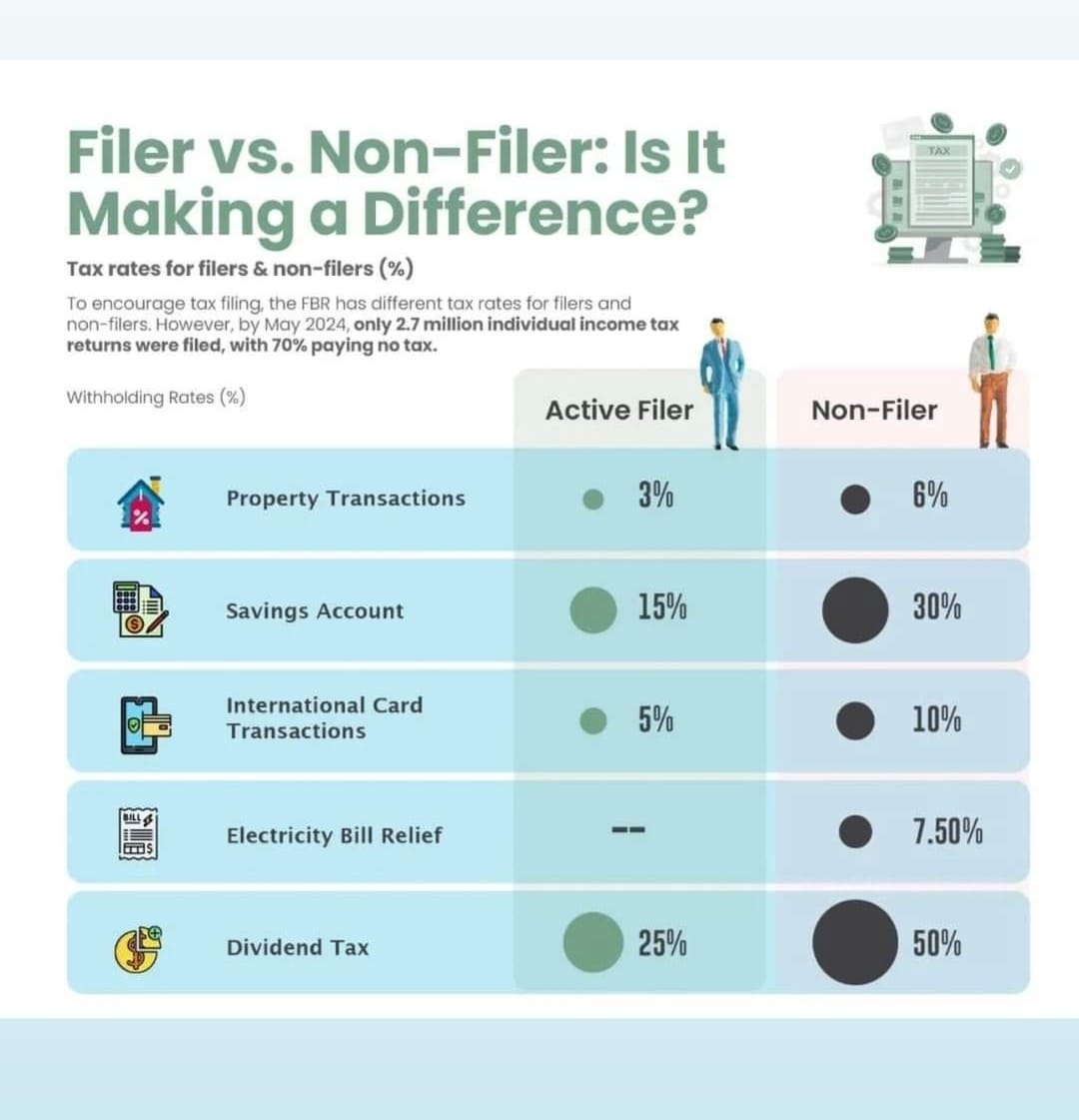

Chapter 5: Taxes in Real Estate Sector for Filer and Non-Filer

The 2024 budget continues to differentiate tax implications for filers and non-filers in Pakistan’s real estate sector. Here’s a breakdown:

For Active Filers:

- Property Transactions: Tax rate of 3%

- Savings Account: Withholding tax rate of 15%

- International Card Transactions: Withholding tax rate of 5%

- Electricity Bill Relief: Not applicable

- Dividend Tax: 25%

For Non-Filers:

- Property Transactions: Higher tax rate of 6%

- Savings Account: Withholding tax rate of 30%

- International Card Transactions: Higher rate of 10%

- Electricity Bill Relief: A significant 7.50% rate

- Dividend Tax: A more substantial rate of 50%

This tax structure is designed to encourage tax compliance, with non-filers facing considerably higher rates, which significantly impacts the cost of real estate transactions. The differential treatment aims to improve tax collection from property transactions and other related financial activities, influencing investment decisions and market dynamics significantly.

By understanding these tax implications, investors and developers can make more informed decisions, optimizing their financial strategies in line with the Pakistan budget 2024.

Chapter 7: How Real Estate Professionals View the Budget 2024

Real estate professionals are generally optimistic about the immediate effects of the Pakistan budget 2024 but remain concerned about the need for consistent policy frameworks. They advocate for policies that not only address current market challenges but also provide a stable foundation for future growth. This includes further incentives for sustainable development and enhanced infrastructure investments.

Chapter 8: Actual Impact of the 2024 Budget on the Future of Real Estate

While the Pakistan budget 2024 sets a positive tone for the near future, its long-term impact on Pakistan’s real estate sector will largely depend on subsequent policies and global economic conditions. If the government continues to support the sector through thoughtful policies like Property E-Registration, it could lead to sustained growth and stability. However, any shifts in the global economic landscape or domestic policy changes could alter these projections.

Chapter 9: Recommendations for Developers and End Users Post-Budget 2024

Developers and end-users should leverage the current supportive measures to advance their projects and investments. It is advisable to keep a close watch on policy developments and Real Estate market trends to adapt strategies accordingly. For individual investors and homeowners, the budget presents an opportunity to reassess their investment portfolios and consider new entries while the conditions are favorable.

Conclusion

As Pakistan unveils its 2024 budget, the real estate sector stands at a crossroads of opportunity and challenge. For developers and end-users, this year’s budget presents a unique chance to capitalize on favorable conditions such as reduced tax burdens and incentives for overseas investors. However, navigating this evolving landscape demands vigilance and strategic planning. Stakeholders should actively engage with ongoing policy changes, stay informed about market trends, and adapt their investment strategies to maximize benefits from the current fiscal measures. By proactively leveraging these insights, both developers and homeowners can ensure they not only survive, but thrive in the dynamic world of real estate in Paistan.

Stay ahead of the curve by keeping informed on the latest policy changes and market trends. Follow us for more deep insights from the Pakistan’s Real Estate Market!